As we settle into the fourth quarter, changes are happening in the transportation industry. From ongoing changes in market conditions, technology, and regulations, below are key insights into the latest trends in freight rates, driver availability, emerging technologies, and more. It is important for transportation companies to keep updated with these changes as we navigate through the final quarter of the year, which is why we conduct market research to prepare for what is coming next.

Economic Overview

The overall economy hasn’t left the transportation sector unscathed. Inflation, fuel prices, and interest rates have gained significant influence in dictating freight volumes, rates, and capacity. According to a market forecast, freight volumes have seen varied growth across different regions, with some areas benefiting from stronger retail and agricultural demand.

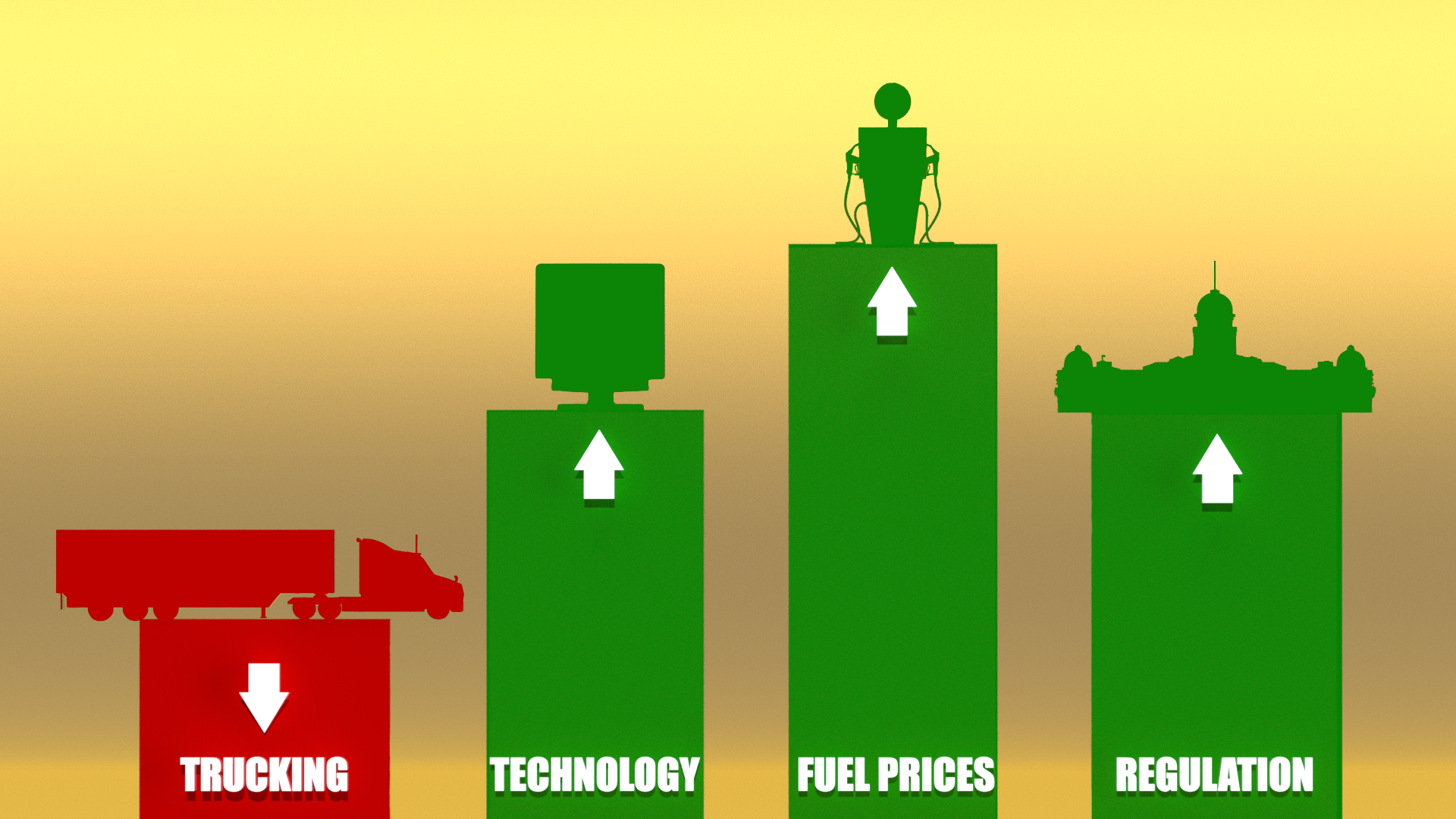

Key performance indicators, such as freight rates and driver availability, continue to evolve. While freight rates have remained stable for the most part, operations have been stretched by swings in fuel prices and a drying driver supply. The carriers are working on how to handle these economic factors in order to reduce costs without sacrificing service. The economy has made changes necessary in the trucking sector.

Trucking Sector

The trucking industry, being at the core of the transportation industry, has always faced a mix of opportunities and challenges. The rates for spot and contract have become quite volatile, changed by supply chain disruptions and altered demand patterns. According to the DAT trendlines 2024 has seen a consistent decrease in spot trends for nearly all shipping methods with a yearly overall decrease of 19.6% in spot load posts. In 2024 Reefer spot rates have decreased by 3.6%. This is good news for shippers who can expect reduced costs in the upcoming holiday season. Carriers will be less happy to see the consistent decrease in rates as they represent lost potential income as supply increases to meet demand.

The shortage of drivers is only worsened by the aging of the workforce and high levels of employee turnover. It is volatile fuel prices that continue to hurt profit margins, flagging efficient fuel management by fleets. (Transport Topics).

Despite these challenges, the demand for trucking remains high, especially as we move into the holiday season. A recent report predicts a significant increase in online holiday spending, which will put further strain on supply chains. This highlights the trucking industry’s crucial role in ensuring timely deliveries and maintaining consumer satisfaction during peak seasons.

Technology and Innovation

Technological changes are now visible in transport in 2024. Artificial intelligence, automation, and electric trucks no longer appear as concepts but are integral to the modern fleet. AI is gaining traction with many different companies as it has improved load boards. Companies like DHL are making their operations pursue a growth strategy with an emphasis on innovation and sustainability. (Transport Topics).

Digital platforms also contribute significantly to efficiency improvements, from route optimization to freight matching that helps reduce empty miles and improves profitability. Sustainability initiatives are making the industry take the path of greener logistics solutions, which again is a changing space in fleet management and drives the development of electric and hydrogen fuel cell technologies.

Regulatory Updates

The regulatory environment has remained one of the significant factors that always influence the transportation industry. Changes in legislation regarding fleet management, safety, and environmental standards have been posing both challenges and opportunities for companies operating in this field. Some of the challenges will include adapting fleet managers to new safety regulations while ensuring compliance with new environmental policies aimed at reducing carbon footprints. Understanding such new and evolving regulations is quite crucial for remaining operationally effective and penalty-free.

Demand Shifts

Freight demand often fluctuates across different regions due to a combination of factors such as economic conditions, manufacturing outputs, and agricultural activities. In Q4 2024, some freight routes are experiencing growth as industries ramp up production to meet seasonal demands, while others are seeing a decline due to a contraction in key sectors. Transportation companies must remain aware of these shifting trends to take timely corrective actions and adjust their operations. By monitoring regional demand changes, companies can allocate resources more effectively and maintain the efficiency of their freight networks.

For instance, as Zipline Logistics highlights in their 2024 Q4 Market Update, economic slowdowns and reduced output from specific industries are key drivers behind declining demand in certain regions. This creates a complex environment where transportation providers must remain agile, adapting their capacity and routes to the most profitable and stable markets. Staying ahead of demand shifts allows companies to navigate volatility while continuing to deliver optimal service to their customers.

Conclusion

For Q4 2024, the transportation industry stands at the crossroads of economic, technological, and regulatory changes. From driver shortages to the uprising of AI and electric trucks, transportation companies must be in the know and ready to adapt. Going into the future, these trends will continue to shift, and their impact will have to be watched closely by each business to make adjustments so that they can remain competitive.

Follow our blog to stay connected with the latest in transportation, subscribe to learn more about market trends, and catch the latest from the industry.